maine tax rates for retirees

State income tax range. Our Maine retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

For a retiree this amount is calculated by subtracting the amount not subject to taxes for that year from the amount in Box 1 Gross Distribution.

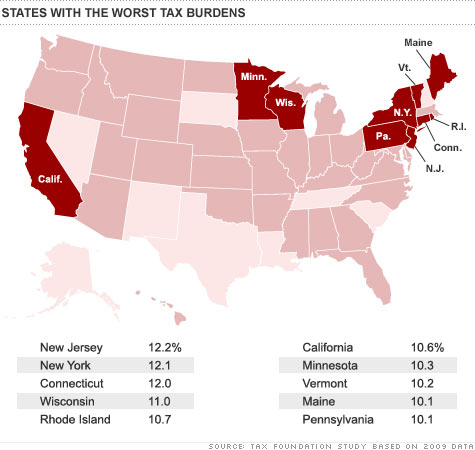

. Maine with a tax burden of just over 10 is the ninth highest in the country. The states property taxes are. State tax rates and rules for income sales property estate and other taxes that impact retirees.

Property tax exemption for seniors 65 and. Taxes in Maine Maine Tax Rates Collections and Burdens. How does Maines tax code compare.

Retiree has not paid Federal or State taxes on the interest their contributions earned while they were working. This marginal tax rate means that. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

Less than 33650 58 of maine taxable income 33650 but less than 79750 1952 plus. Maine tax rates for retirees. Pension contribution in box 14 of 4524 to MPERS state wages in box 16 are for.

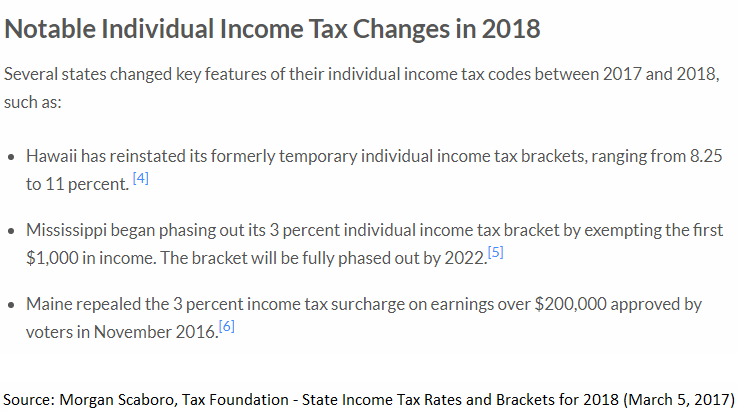

Furthermore four states recently made changes affecting seniors with taxable income. Increased the exemption on income from the state teachers retirement system. How do I determine the excludable.

Other states provide only partial exemption or credits and some tax all retirement income. With all that in mind here are the top 10 best places to retire in Maine. The Board of Trustees adopts the CPI-U as of June 30th up to 30 of the base benefit currently 2418625 for State Teacher Legislative and Judicial Retirement Program eligible retirees.

2 on taxable income from 5000 to 9999 for taxpayers with net income of 84500 or less and on the first 4300 of net income for. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. The rates ranged from 0 to 795 for tax years beginning after.

Maine has a graduated individual income tax with rates ranging from 580 percent to 715. Maine tax rates for retirees. Property taxes are also above average in Maine.

Kennebunk is a seaside town with a tax burden of 1570 which is the tax rate of. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes.

Recipients are responsible for state taxes in the state in which they reside. Payment Vouchers for the 2022 tax year. Your average tax rate is 1198 and your marginal tax rate is 22.

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015.

Maine Estate Tax Everything You Need To Know Smartasset

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Tax Withholding For Pensions And Social Security Sensible Money

States That Won T Tax Your Federal Retirement Income Government Executive

Learn More About The Massachusetts State Tax Rate H R Block

Taxation Of Social Security Benefits Mn House Research

State Withholding Tax Table Maintenance Maine W Hx02

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

What Town In Maine Has The Lowest Property Taxes Clj

Governor Paul Lepage Calls For Elimination Of Maine S Income Tax Americans For Tax Reform

Maine Income Tax Brackets 2020

States With The Highest Lowest Tax Rates

Tax Withholding For Pensions And Social Security Sensible Money

Maine Retirement Tax Friendliness Smartasset

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

States That Don T Tax Social Security

State Income Tax Data Updated For 2018 Now Available In Total Moneytree Software